China’s Belt and Road Initiative (BRI) introduced back in 2013 is responsible for a new era of transit routes, trade, and growth for economies in Asia and around the world. Learn about the latest developments of this massive project and how you can save money on the China to Europe routes. By the end of the blog, we’ll also guide you to find containers of your choice at competitive rates.

With the Belt and Road Initiative, China has sent more than 11,000 freight trains to Europe and back. And more than 65 rail freight routes have been opened between China and 44 cities in 15 European countries, compared to ten years ago. The growing importance of rail freight from China to Europe is closely linked to China’s geopolitical strategy aimed at extending its sphere of influence.

The faster and cheaper the block trains move cargo from China to Europe, the more attractive it gets for European importers. With this article, we help you understand the Chinese Belt and Road Initiative. And provide you with strategies that increase your profit margins and flexibility for the cargo you move from China to Europe. By eliminating repositioning costs and demurrage and detention charges.

But if you already have cargo waiting to be picked up and you’re looking for a container right away, try our public search below. All you have to do is select “I want to use containers” and then key in your pick-up and drop-off locations; take your pick from 50,000+ units supplied by 1,500+ certified members at competitive, comparable, and negotiable rates. Try it now!

What is China’s Belt and Road Initiative or BRI?

China’s Belt and Road initiative (aka ‘One Belt One Road’) is a massive infrastructure project that stretches around the globe to help facilitate trade between China and other parts of the world.

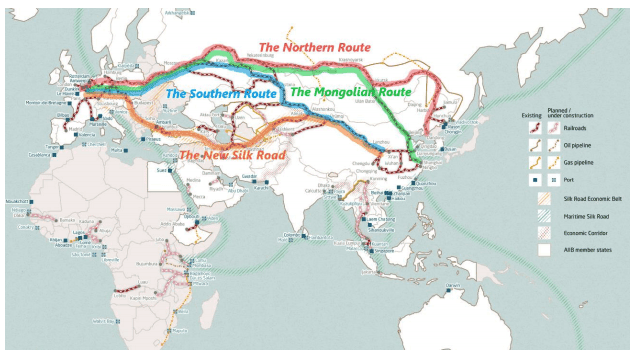

The BRI comprises a trans-continental passage that links China with Southeast Asia, South Asia, Central Asia, Russia, and Europe by land (via rail). And sea shipping routes connecting China’s coastal regions with Southeast and South Asia, the South Pacific, the Middle East, and Eastern Africa, all the way to Europe.

Around 152 countries are actively a part of the Belt and Road Initiative (BRI), and China has been heavily investing in Asian and European countries in many industries. These industries include banking, automobile, robotics, power utility, solar farms, and ports.

What does Belt and Road Initiative mean for global trade?

The Belt and Road Initiative impacts global trade to a great degree:

- It’s the world’s largest platform for regional collaboration with two parts to it – the belt being the physical road, which starts in China and runs all the way through Europe. And the road referred to the maritime Silk Road, in other words, shipping lanes, from China to Venice. This covers about 65% of the world’s population, about one-third of the world’s GDP, and about a quarter of all the goods and services the world moves.

- BRI countries’ contribution to global exports has nearly doubled in the last two decades.

- It currently takes about 30 days to ship goods from China to Central Europe, with most goods being transported by sea. Moving goods by train can cut transit time in half, and the belt side of BRI with railway networks helps with the fast movement of goods.

With improved connectivity, faster transit times, and a huge contribution to the world’s GDP, the BRI is a great initiative to be a part of. So, if you’re looking for containers on any Belt and Road initiative stretches schedule a demo

Latest developments in the Belt and Road Initiative

In 2020, the FDI for BRI was US $154 billion, ranked as the world’s number one overseas investor. The increase in Chinese investment in BRI countries has also been impressive.

In 2022 the Qingdao Port in eastern China opened 38 new routes. These routes were mostly along the Belt and Road Initiative route and catered to emerging markets such as Southeast Asia, Latin America, and the Middle East as opposed to the US or North Europe.

The port handled almost 7 million 20-foot TEUs in Q1, recording a 16.6% increase since Q1 2022.

According to the General Administration of Customs of China, the country’s exports of intermediate goods to nations of the Belt and Road initiative rose 18.2% in the first quarter from the year earlier to US $158 billion, representing more than half of all exports to these countries.

As the demand for Chinese exports moves toward new regions, prices for container shipping to these regions have gone up too. At the beginning of May 2023, the average price of a 20ft container being shipped from Shanghai to the Persian Gulf was 50% above this year’s lows, according to the Shanghai Shipping Exchange. And the average prices in eastern South America were up more than 80%.

As of 2023, BRI plans to expand economic and trade ties to Afghanistan through the China-Pakistan Economic Corridor — a package that includes mega projects such as road construction, power plants, and agriculture.

Future of the Belt and Road Initiative by China

Being the world’s leading economic superpower at the center of a new global trade network always comes at a cost. With multiple high-speed rail networks to reach Western Europe, and massive ports across Asia and Africa for shipping, the Belt and Road Initiative (BRI) has required a lot of funding – a rough figure of more than US $1 trillion.

Now as it heads into the future with more funding and more advancements here’s what it has in store:

- Ensuring the success of a series of key initiatives in the tenth-anniversary series of the Belt and Road Initiative in 2023.

- Making efforts to merge and expand realistic collaborations with co-building countries, with a focus on achieving tangible results.

- Preparing for the upcoming Third Belt and Road International Cooperation Forum.

- Greater support for the development of overseas warehouses and accelerating efforts towards building a strong trade nation.

- Emphasis on deeper integration of domestic and international industrial and innovation chains, particularly in critical areas such as 5G and new infrastructure.

- And a strong focus on renewable energy technologies and environmental sustainability.

With so much to look forward to, now would be a good time to use the BRI routes to get your cargo to its destination; and we can help you with just that!

Find containers for your cargo on the BRI stretch on Container xChange

You can get your box (be it units for sea or train containers) for your cargo, on our platform at comparable and competitive rates with no hidden fees, thanks to our complete market price transparency. The rates you see are all stated upfront and are negotiable too so you can be sure of what you are paying and why, before signing a deal.

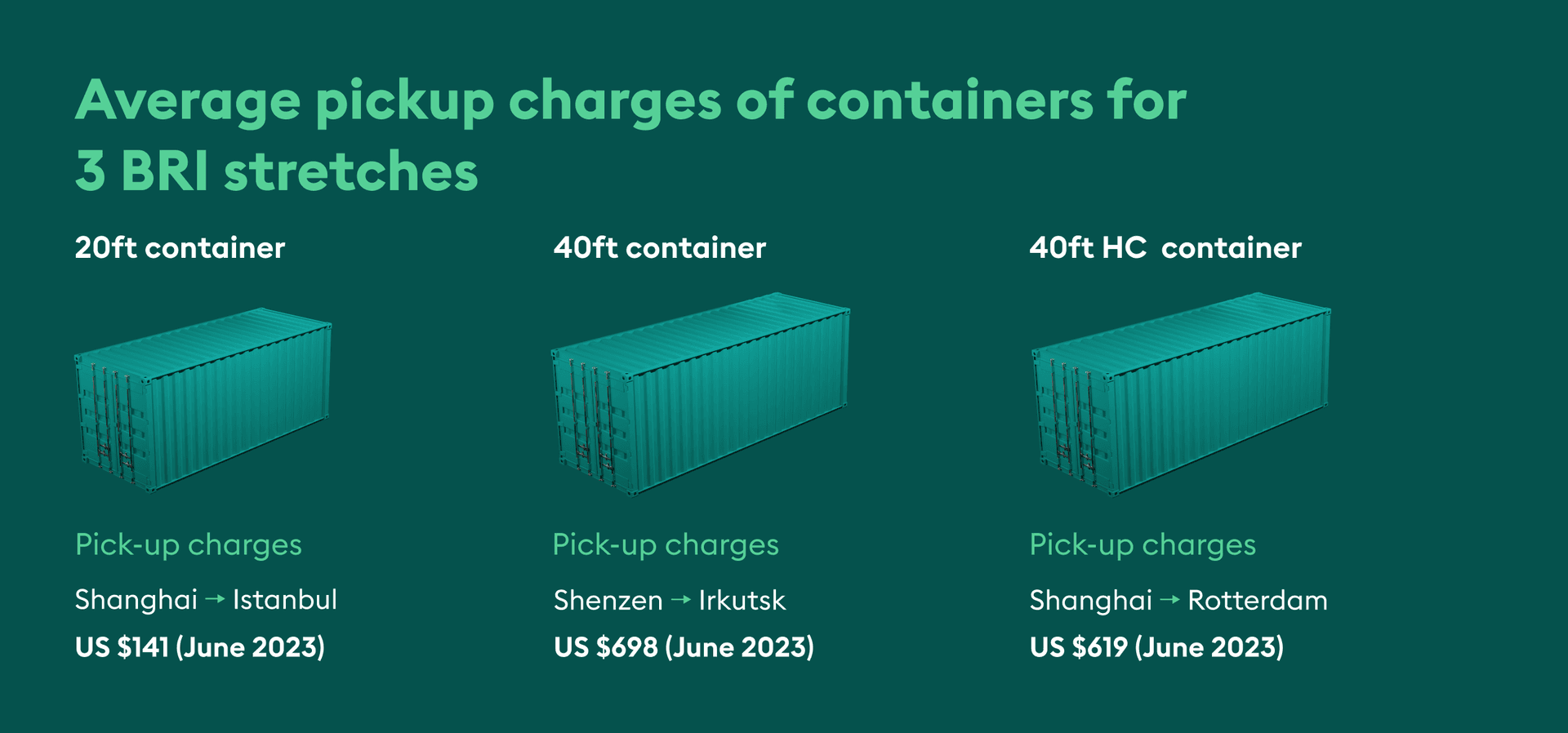

Have a look at the average pick-up rates from China to Europe for standard containers on our platform below:

Now when it comes to our container suppliers, rest assured they’re all vetted and certified. All members go through a mandatory vetting process to ensure credibility and your safety. You can also view the profiles of these companies and see the ratings and reviews given to them by their peers. This way, you can make informed decisions about who you want to work with. container leasing also offers easy and safe payment handling – xChange wallet. Here you’ll only get one consolidated bill to pay at the end of the month. You’ll also get to see your complete transaction history.

See for yourself how easy we make sourcing a container; help you streamline your operations and ease your workflow by clicking the banner below.

Empty container repositioning, a widespread issue on the BRI stretch

Despite all the good news backing up the Belt and Road initiative, there is a major setback when it comes to transporting cargo on this stretch to Europe – empty container repositioning.

Looking at freight from China to Europe, there’s a huge difference in the westbound and eastbound volume: 80% of eastbound containers are empty, while 89% of westbound containers are fully loaded. This causes a disruption in the container flow

It’s been noted that for every two full containers arriving from China, only one returns the other way. Empty containers are a huge problem as they reduce flexibility and negatively impact profit margins.

Also, forwarders purchase slots directly in China but have to bring their own (shipper-owned) containers as rail freight operations only provide slots. So, most forwarders either buy containers in China or lease them from a leasing company. But what happens to the container in Europe? Idle time is expensive; finding someone who buys the container in Europe or organizing an empty container to move back to China takes a lot of time. Selling a container in Europe means you have to buy new equipment in China again and in addition to that, it is sometimes not even possible to sell containers because of container lease agreements

But did you know that the solution to this problem is leasing SOC containers? Read on to find out more about this.

Lease SOCs one way to curb empty repositioning and D&D costs schedule a demo. And since you’ll need SOC containers for transporting cargo from China to Europe, why not get your box on our platform with just a few clicks? Plus, once you have moved cargo from China to Europe, you can sell the container again on our trading platform at a good price and help in repositioning them!

Also, by using SOC containers you can save a lot of money on demurrage and detention as your daily container rental fees do not depend on the duration of the rental. They stay the same price per day.

If you want more insights into the other benefits of SOCs, which of the big industry names are keen on SOCs, and examples of possible one-way SOC moves, then learn more

Now, with your SOC in place, you can opt for one-way container leasing. You can move your SOC back from Europe to China on a one-way journey without incurring the costs of empty container repositioning. schedule a demo

Get your SOC container at your fingertips on Container xChange

If you’re now planning to send your cargo across the largest network of trade routes – the Belt and Road Initiative, you know you’ll need to lease SOCs from China to avoid the issue of repositioning. So, let xChange help you out with that in just a few steps.

- Log on to our leasing platform

- Choose ‘I want to use containers’

- Type in your pick-up and drop-off locations and hit ‘search’

- You will get a list of available containers on that particular stretch

- You can ‘view details of the suppliers and the deals they’re offering

- Choose a supplier you like after seeing their reviews and ratings

- Connect with them directly via chats and calls on the platform

- Interact with them to compare and negotiate deals and terms

- Choose a rate that suits your budget, close your deal, and get your box

One of our customers, FELB, uses our platform to identify partners that reposition equipment back to China, (almost) for free. The platform helps them find partners, set up agreements, track containers in near real-time, and handle their payments to make empty container repositioning as simple as possible. Here’s what they have to say:

“We joined Container xChange because it exposes us to great opportunities to balance our fleet. The imbalance between the Westbound and Eastbound is about 3:1, so we can quickly lease extra units when we have a shortage or supply our units when the market is low” –Alexander Redkin, COO of FELB.

If you have empty containers that need to be repositioned to China or any other location or if you’re looking for SOCs to move cargo from China to elsewhere, our team is here to help you on this journey. Click on the banner below to get started today.

What is the China Belt and Road Initiative?

China’s Belt and Road initiative is a massive infrastructure project that is stretched around the globe to help facilitate trade between China and other parts of the world.

How many countries are part of BRI?

Around 152 countries are actively a part of the Belt and Road Initiative (BRI), and China has been heavily investing in Asian and European countries in many industries.

Why is it called Belt and Road?

The belt is the physical road, which starts in China and runs all the way through Europe. And the road refers to the maritime Silk Road, in other words, shipping lanes, from China to Venice.

![What is the Belt and Road Initiative? Latest developments [+ how to secure top deals]](/_next/image?url=%2Fblog%2Fbelt-and-road-initiative-featured.jpg&w=1920&q=75)