Incoterms rules are followed in international sales contracts. Read on to learn more about them, why they are essential for your business, their uses, and the different types. By the end of the blog, you’ll also have an understanding of the pros and cons and know the benefits of digitizing your logistics.

The shipping industry plays a vital role in the global trade business and connects different locations across the world. But the challenge here is that each region has its own language. Thus, it gets difficult when drafting trade and sales contracts. This is where Incoterms come in handy. Incoterms provide a standard format and a language that is accepted and understood by every trading company globally.

Being part of the shipping industry, it’s very important for you to stay updated about these terms as well as the latest industry news. This allows you to negotiate better deals as you know what’s happening in the industry.

To help you with this, we publish our monthly ‘Where are all the containers” report. Through this report, you’ll get the updated container prices, availability and market trends in locations across the globe. It’s absolutely free and you’ll get alot of insights that’ll help your business grow.

Interested to read it? Click the banner below to download the report now.

What are Incoterms?

Before we delve deep into the latest changes and rules, it’s essential that you familiarize yourself with the term itself. Let’s begin by understanding the meaning of Incoterms.

Incoterms expand to International Commercial Terms. The International Chamber of Commerce (ICC) sets these global trade rules. They are used and followed in International sales contracts.

The ICC developed Incoterms in 1936 with an aim to encourage fair play in trade and easy interpretation of commonly used commercial terms. Although adhering to Incoterms is voluntary, they provide clarity on various responsibilities of buyers and sellers in commercial trade transactions. They’re essential prerequisites for international sales contracts.

To help you better understand, let’s take a look at their use in international trade.

Use of Incoterms in International Trade

The use of Incoterms in International trade is of vital importance. The intention of the International Chamber of Commerce is to bring fair play among different trading parties. And these terms and terminologies help everyone to stick, use and adhere to a common ground.

These common terms, rules, and definitions of Incoterms, by an International body, are globally accepted. They are now prominently used in commercial sales contracts by various trading companies. Their use in shipping helps in easy container clearance as well.

Though the use of Incoterms is not mandatory, it’s recommended. It’s the same as using digital solutions in logistics to avoid confusion, delays, risks, and overwhelming trade costs. These terms provide you with clarity on the legalities for costs and risks. Thus, it’ll help you stay aware of your responsibilities in a global supply chain.

To begin, take a look at how these terms are categorized to facilitate global trade in an effective manner.

4 classifications of Incoterms

Just like we have container owner codes, we also have Incoterms that play an essential role at every stage of shipping activities. They come in handy when you’re:

- Filling out a purchase order

- Labeling a shipment for transport

- Preparing a certificate of origin

- Creating a bill of landing, or

- Documenting a Free Carrier Agreement (FCA)

Incoterm is a three-letter code followed by a location. For example, EXW Hamburg.

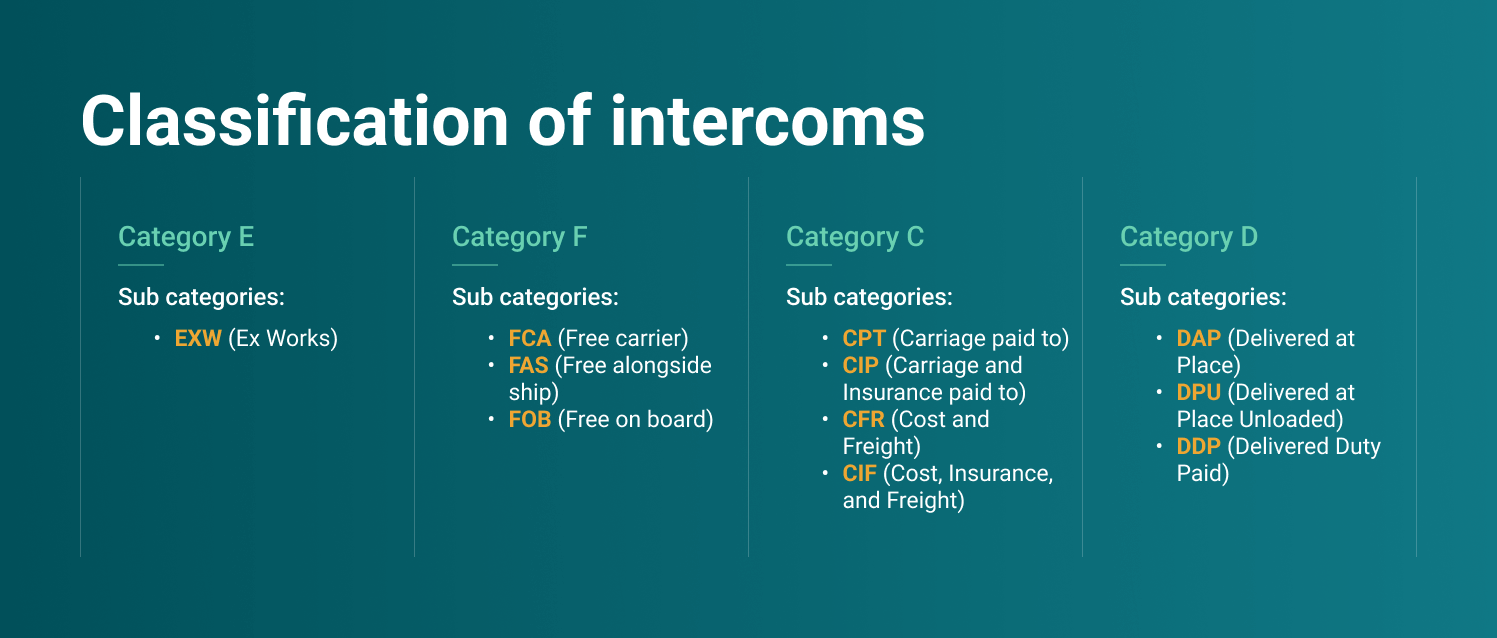

The International Chamber of Commerce classifies Incoterms into four principal categories — E, F, C, and D for easy understanding.

Category E

Category E has only one trade term — EXW (Ex Works). Here, the exporter or seller makes goods available at his premises for the importer or buyer.

Category F

Category F has three main trade terms — FCA (Free Carrier), FAS (Free Alongside Ship), and FOB (Free on Board). A seller is responsible for loading and delivery of goods to a carrier.

Category C

Category C contains four trade terms, including CPT (Carriage paid to), CIP (Carriage and Insurance paid to), CFR (Cost and Freight), and CIF (Cost, Insurance, and Freight). Here, an exporter or seller is only responsible for arranging the shipment and not for any damage.

Category D

Category D contains three trade terms — DAP (Delivered at Place), DPU (Delivered at Place Unloaded), and DDP (Delivered Duty Paid). The seller is responsible for both the cost and risk of delivering the goods.

These four categories are further divided as per the mode of transportation. Below is a table for your understanding.

Incoterms rules for any mode of transportation

To make it easy for you to understand, here’s a table of Incoterms rules for any mode of transportation.

| Incoterms | Meaning | Short explanation |

| EXW | Ex Works | Seller places the goods at buyer’s disposal |

| FCA | Free Carrier | Seller delivers the goods to the buyer at seller’s place |

| CPT | Carriage Paid To | Seller is responsible to get export clearance and also transport the goods to the carrier |

| CIP | Carriage And Insurance Paid To | Same as CPT, but the seller also contracts for insurance |

| DAP | Delivered at Place | Seller is responsible for delivery of the goods to the agreed-upon place, usually the buyer’s premises. They also bear all costs and risks associated with it |

| DPU | Delivered at Place Unloaded | Same as DAP, but the seller also pays for unloading the cargo at the place of destination |

| DDP | Delivered Duty Paid | Seller has all the responsibility related to cost & risk while transporting cargo |

Incoterms rules for sea and inland waterway transport

Now let’s look at the 4 common Incoterms for sea and inland waterways.

| Incoterms | Meaning | Short explanation |

| FAS | Free Alongside Ship | Seller delivers the goods alongside the ship at agreed port of shipment |

| FOB | Free on Board | Seller delivers the goods at the board of the ship at the agreed port |

| CFR | Cost and Freight | Same as FOB but the seller also pays the cost of freight until the destination port |

| CIF | Cost, Insurance and Freight | Same as CFR, but the seller also pays insurance to cover buyer’s risk of loss or damage during transportation |

Now that you’ve got an overview of all the rules, let’s understand them in more detail.

7 common Incoterm 2020 rules for any mode of transportation

You’ve already read about the 11 Incoterms further up in the piece. But to make it easier for you to understand, let’s look at these Incoterms categorically.

Here are the 7 common rules for any mode of transport and what they stand for.

EXW (Ex Works)

You, as a seller, are only responsible for making the goods available for the buyer to pick up at your premises. This place can be your factory or warehouse, as agreed upon. This is done on the said date and time frame.

Here, you aren’t responsible to load the goods or clear them for export. EXW is the only Incoterm where the buyer is responsible for export clearance. All that you need to do is provide all details that the buyer needs during the delivery of goods.

The buyer is responsible for all risks and costs — from the pick-up time until the delivery destination. You have minimal commitment under the Ex Works Incoterm.

FCA (Free Carrier)

Under the Free Carrier Incoterms, you hand over the goods to a carrier or another person nominated by the buyer. This handover is done at your premises — factory or warehouse. Unlike the EXW Incoterms, you’re responsible for loading the goods on the buyer’s transport. Additionally, you’re also responsible for the delivery of goods to the port and export clearance. Under the FCA Incoterm, there are no insurance obligations on you or the buyer. According to Incoterms 2020, FCA allows both parties to agree on the contract that buyers must instruct International carriers to present a BoL with an onboard notion to you.

CPT (Carriage Paid To)

Here, your responsibility is to clear goods for export and also deliver the goods to the carrier. Another added task for you is to incur all international freight transportation costs essential to deliver the goods to the destination.

The risk is transferred to the buyer as soon as goods are delivered to the international carrier. This means the buyer’s responsibility begins from loading the goods onto the carrier until the final delivery location.

CIP (Carriage and Insurance Paid To)

Your responsibilities under the CIP Incoterms are the same as the CPT Incoterms. That is you hand over the goods to the carrier and also clear goods for export. In addition to this, you’ve to arrange for insurance to cover the buyer’s risk and damage to goods from the place of delivery to the destination location. The insurance amount has increased under Incoterms 2020 rules for CIP. According to the new change, it should be at least 110% of the value of the goods and transportation expenses.

DAP (Delivered at Place)

Under the ‘Delivered at Place’ Incoterm, you’re responsible for delivery of goods to an agreed-upon place of destination. This can be the buyer’s premises or warehouse. Here, you have to take care of all costs and risks related to:

- the delivery of goods,

- unloading the cargo,

- customs clearance, and

- have all import permits and documentation handy.

DPU (Delivered at Place Unloaded)

DPU or Delivered At Place Unloaded is the new change under Incoterms 2020. This term was previously known as DAT (Delivered At Terminal). The new change allows delivery of goods other than a said terminal. As a seller, your obligations, under DPU, are similar to DAP other than the fact that you also pay for unloading the cargo at the place of destination. Here, it’s not your responsibility to arrange for insurance, unlike the CIP Incoterm. The transfer of risk happens once the goods are unloaded at the destination location. DAP comes in handy when you’re dealing with multiple consignees or consolidated containers.

DDP (Delivered Duty Paid)

The DDP incoterm is quite opposite to EXW, where you have the maximum obligation. You bear all the risks and costs related to:

- the delivery of goods to the destination place,

- clear them for both export and import,

- pay duty for the same, and

- clear customs formalities.

This may be challenging you for a number of reasons.

- You may be unaware of the import clearance procedure of the importing country.

- You’ve to deal with foreign currency and the risks involved with it, and

- Deal with roadblocks where some importing countries don’t encourage non-resident importers.

Therefore, it’s considered to be a risky term for sellers and importers. Under DDP, you have to either arrange the carriage at your expense or conclude the contract of carriage. However, it’s not your responsibility to arrange for insurance.

Incoterm rules for sea and inland waterways

Now let’s look at the 4 common Incoterms for sea and inland waterways.

FAS (Free Alongside Ship)

As the term signifies, you deliver goods alongside the ship at the agreed port of shipment. Once the goods are alongside the vessel, the transfer of risks and costs passes on to the buyer. This term is especially useful for goods that are difficult to load.

FOB (Free on Board)

Under this Incoterm, you deliver goods, for export, on board the ship at the agreed-upon port. From this point on, the buyer takes responsibility for the risks and costs of goods.

CFR (Cost and Freight)

As a seller, it’s your responsibility to deliver the cargo on board the ship at the mutually agreed port of shipment. You also pay the cost of freight until the destination port. The transfer of risk of loss or damage of goods happens once goods are on the ship at the port. You and your trading partner can use this Incoterm only for sea and inland waterway transport.

CIF (Cost, Insurance, and Freight)

Here, you are responsible for:

- delivering goods on board the ship,

- paying the cost of freight until the destination port, and

- arranging minimum insurance to cover the buyer’s risks of loss and damage of goods during the carriage.

The transfer of risk of loss and damage passes on to the buyer once the goods are on the ship. The buyer assumes the responsibility for all costs related to the unloading of goods at the destination port. A buyer also takes care of import clearance.

After reading so much about what’s covered by Incoterms, you must think that these rules cover everything. However, that’s not true. Read on to find out what isn’t covered under Incoterms.

What’s not covered by Incoterms

As you know by now, Incoterms are part of the global sales contracts. You’re also aware of the importance of using Incoterms for your international trade. So, what’s more? Well, we’ll now look at one of the most essential points — aspects that Incoterms don’t cover.

It’s important to know them as it’ll help you understand and negotiate certain sales contracts better.

- So first things first, Incoterms don’t cover breach of contract and Force Majeure events such as war, unexpected strikes, natural calamities, and so on. Incoterms also don’t include property rights.

- Incoterms also don’t identify goods for sale or the contract price. You’ll also not find the method or a time frame of payment between the seller and buyer.

- They also don’t specify the documents you should provide, as a seller to the buyer for the customs clearance process at the destination.

- A clear mechanism to address the liability for failure to deliver the goods as confirmed in the contract of sale isn’t on Incoterms. Delay in delivery and dispute resolutions too aren’t covered by Incoterms.

So, what can you do when a situation with the above circumstances arises? Discuss them! Yes, state these probable instances with the other party and get clarity on what can be done.

Don’t forget to do this before you sign the sales contract. Make sure that you and your partner are well aware of these situations and have a solution to address them. By doing this, you’ll only ensure smooth business trade.

FCA Incoterms 2010 vs 2020

FCA Incoterms were last updated in 2020. However, there weren’t any major changes in them. Here are some of the minor changes made in these rules.

DAT to DPU

In the new version of Incoterms, DAT (Delivered at Terminal) is replaced with DPU (Delivered at Place Unloaded). This change clarifies the previous confusion around the word “terminal”. The new term signifies all points of unloading and not just terminals.

And under the FCA rule, you, as a buyer can instruct a carrier to issue a Bill of Lading (BoL) with an on-board notation to the seller. Earlier, international carriers refused to issue a BoL to sellers if they didn’t receive goods directly from them. But now, that’s changed.

Also read about Standard Carrier Alpha Code and its uses.

Importance of insurance

In the 2020 version of Incoterms, the need for insurance coverage plays a vital role. The amount of insurance has increased. You can now find it under Clause A of both CIF and CIP rules. Being part of the shipping industry, you know this is the right step because insurance is extremely important.

Speaking of the importance of insurance, did you know that Container xChange also offers insurance for your containers. Insurance protects your container from unforeseen events like bad weather conditions or even containers lost at sea.

Transportation with own vehicles

In the 2010 version, it was assumed that transportation services were provided by a third-party carrier. In 2020 it was changed. Now if you’re using FCA, DAP, DPU, and DDP, you can use your own vehicles for goods transportation, instead of third-party services.

Cost details

Incoterms 2020 gives you in-depth cost details. You can find all costs in one place. This change clearly allocates the charges (as applicable) to different parties. These include security-related prices such as export and import clearance, etc.

To understand these terms better, take a look at their pros and cons.

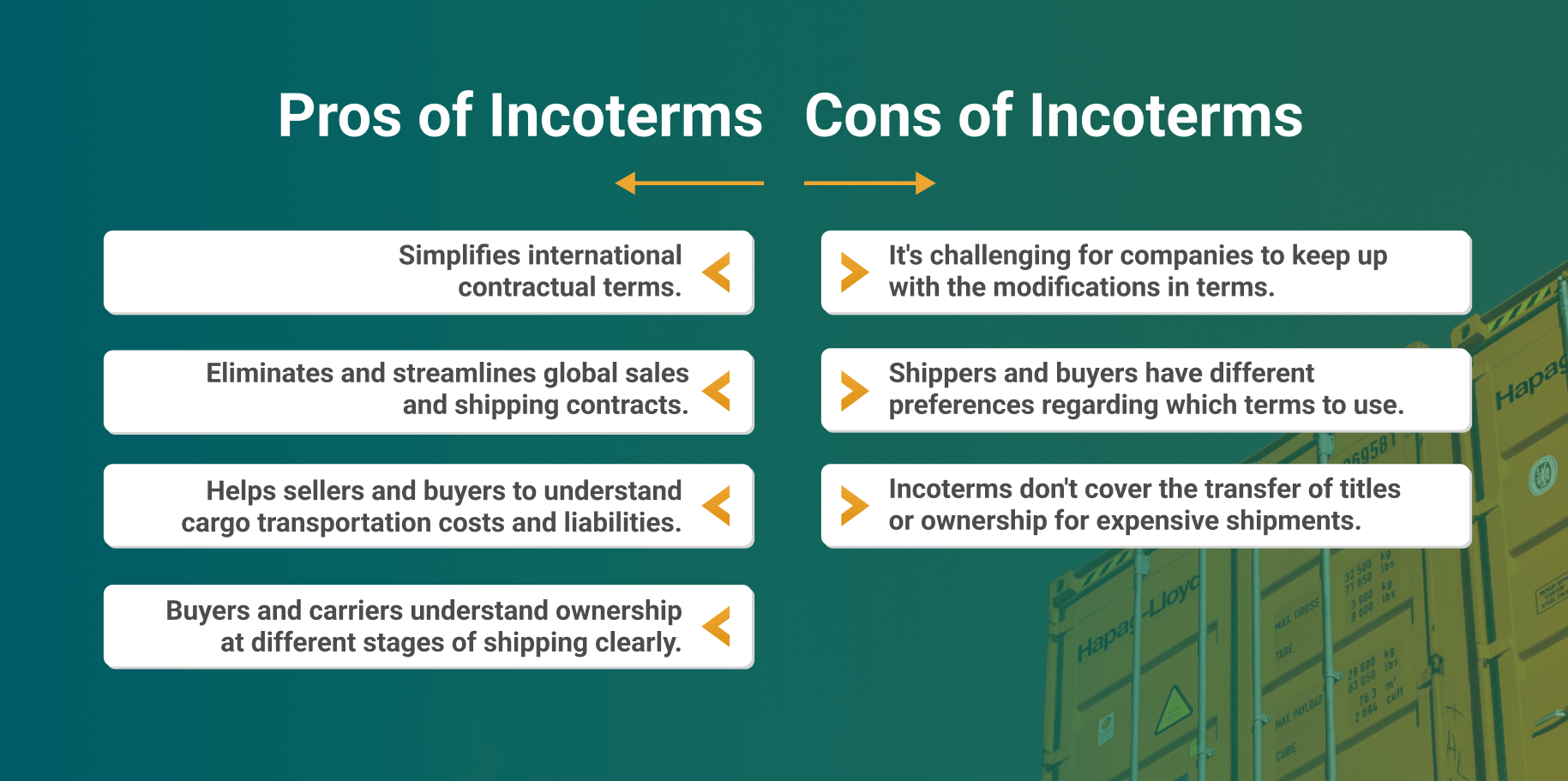

Advantages and disadvantages of Incoterms

Incoterms have great benefits for your business. It provides you with universally accepted trade terms that make International trade smoother.

By adhering to these Incoterms, you can keep a track of what impacts the global supply chain and how you can make the most of it. However, everything has its own pros and cons. And it’s best to be aware of both. So, here’s a list we’ve created for you to make you more aware of Incoterms.

Advantages of Incoterms

- The greatest benefit of using Incoterms is the easy-to-understand internationally accepted terms set up by an International body.

- There is a systematic approach to diminishing complexities and uncertainties between two trading parties. With the standard format, your trading life is simpler, easier, and hassle-free.

- Everyone speaks the same trading language and this in turn saves your time, money, effort, and frustration.

Disadvantages of Incoterms

- Buyers and sellers have different preferences for using Incoterms. For example, you may choose FAS because it helps you better with your shipment. But your buyer may prefer using FOB for the exact reasons.

- Negotiations can be difficult in terms of which option to use and getting clarity on them.

- A few terms can raise the cost for one party. This can again lead to issues with better negotiation deals.

Too many terms and too many responsibilities to remember, huh? One way to reduce this stress is by automating your logistics needs. Here’s how you can do this effortlessly.

Keep essential documents handy and digitally secure with Container xChange

Imagine you don’t have to stress about managing all the various documents required for shipping cargo from one place to another. Each step in the shipping process has several documents and even if one document isn’t in place, you can expect a delay in your shipment. And we all know delays in the shipping industry come at a huge cost.

What if we tell you there’s a way you can digitally secure all your documents and keep them handy? Well, xChange can help you with that and offer much more.

Container xChange helps you minimize the risk of forgetting essential responsibilities with the latest Incoterms by keeping everything in one place. Our platform is integrated with an Application Programming Interface or API that can help you with real-time visibility.

You can digitize your logistics and get updates on your entire fleet at your fingertips in real-time. Additionally, we also provide you with the latest updates on your container movements directly from depots to give you supply-chain visibility.

And it doesn’t end here. You can automate your stock upload and also buy insurance for containers. Thus, we prepare you for any unforeseen situations.

Interested in digitizing your logistics? Or do you wish to know more about what we offer? Simply click the banner below to get answers to all your questions.

Incoterms: Common FAQs

What are Incoterms?

Incoterms are Internally accepted commercial trade terms. These terms are set by the International Chamber of Commerce in an attempt to specify the responsibility of sellers and buyers on the global supply chain. These rules are used in international sales contracts.

What are the 11 common Incoterms?

The 11 common Incoterms are categorized into two segments, rules for any mode of transport and rules for sea and inland waterways. Here are the common Incoterms, EXW (EX-WORKS), FCA (FREE CARRIER), CPT (CARRIAGE PAID TO), CIP (CARRIAGE AND INSURANCE PAID TO), DAT (DELIVERED AT TERMINAL), DAP (DELIVERED AT PLACE), DDP (DELIVERED DUTY PAID), FAS (FREE ALONGSIDE SHIP), FOB (FREE ON BOARD), CFR (COST AND FREIGHT) and CIF (COST INSURANCE AND FREIGHT)

Can 2010 Incoterms be used after January 2020?

Yes, 2010 Incoterms are still valid and can be used by buyers and sellers. However, make sure that you and your partner have agreed to use either version of the Incoterms (2010 or 2020) before signing the contract.