- Mystery Shopper’ undercover survey of the world’s 50 largest freight forwarders finds acceptance of Shipper Owned Containers (SOC) is improving, but remains a rarity despite container shortages

- Just 10% of forwarders surveyed could source an SOC and organise the shipment from China to Europe, finds latest Container xChange report

- Commenting on the results, logistics guru Wolfgang Lehmacher says greater use of SOCs can “empower” forwarders and NVOCCs, and reduce container shortages, shipping costs and risk

Supply chain logjams and box shortages could be reduced if forwarders were more willing to accept shipper-owned container (SOC) moves, according to Container xChange’s 2021 ‘Mystery Shopper’ survey of the freight forwarding market.

“It is clear from the survey results that SOCs are an underused resource, particularly now at a time of stratospheric freight rates and shortages of carrier-owned containers (COC),” said Wolfgang Lehmacher, leading logistics consultant and the former head of Supply Chain and Transport Industries at the World Economic Forum in Geneva and New York.

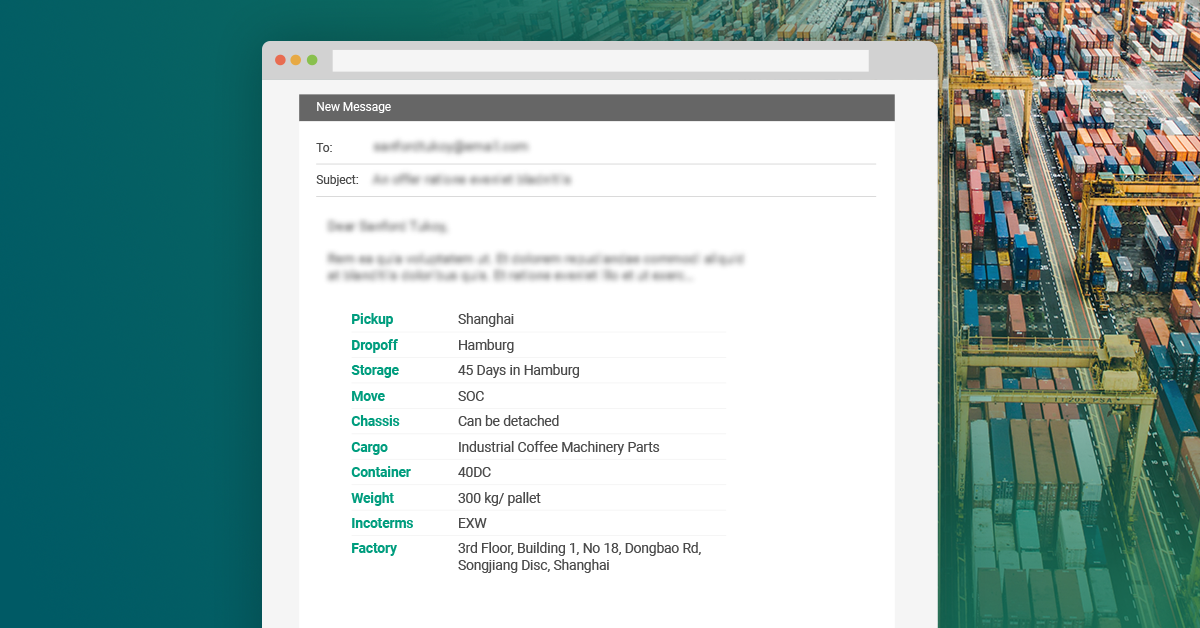

To complete the undercover survey, Container xChange, the world’s leading online platform for buying, selling and leasing shipping containers, established an undercover company. The company then requested quotes from the world’s top 50 freight forwarders for a shipment of industrial coffee machinery parts from China to Germany. The quote request specified 45+ days storage of the cargo in the container in Germany and the use of an SOC container.

Key findings from the Mystery Shopper 2021 survey conducted by Container xChange included:

- 12 forwarders accepted the fake booking but only five (10%) could organise the SOC move and source the container. This was an improvement compared to the 6% of forwarders able to offer this option for a similar move in Container xChange’s 2020 Mystery Shopper survey a year ago.

- Of the 12 forwarders to accept the booking, two offered to buy the container on behalf of the undercover company and five suggested the company supply its own box.

- Of the shipment offers received from forwarders, container pickup charges of between $300 to $2700 were quoted. The huge price range suggested some forwarders were able to source equipment, but others were suffering from box shortages and would need to purchase the container first.

- The top performers were Kuehne+Nagel, CEVA Logistics, Hitachi Transport Systems, Nippon Express and Kerry Logistics.

- 76% of the forwarders contacted could not organize the SOC move or did not respond. Seven of these forwarders declined the shipment and five replied but failed to offer a viable solution after three follow-up enquiries.

“I think there are opportunities for SOC moves for agile forwarders,” said Lehmacher. “I think at the present time the SOC advantage of avoiding demurrage and detention charges is a huge business plus. But shippers, forwarders and NVOCCs can all benefit from using SOCs – they are an additional instrument in the mix of managing the container enabled supply chain.

“Carriers can also benefit from higher customer satisfaction and fewer disputes about detention and demurrage charges. And SOCs can also solve some of their struggles returning containers.”

SOC Containers: Pros and Cons’

The majority of containers used by forwarders and shippers are carrier-owned containers (COC). Using COCs enables shippers to buy moves from container lines at ‘all-in’ freight rates including the supply of the box. After the container is unstuffed, it is returned to the carrier’s depot and there are no further obligations to move or utilize it.

SOCs are used less often mostly because finding boxes from reliable sources can be time-consuming. However, when trade imbalances create shortages they can be very useful, especially when carriers are charging premiums for usage of COCs. SOCs also allow the shipper to take control of trucking costs and can act as an insurance against costly carrier demurrage and detention charges.

“SOCs empower forwarders and NVOCCs to offer a broader spectrum of options to their customers to increase flexibility, mitigate risk, and manage cost,” said Lehmacher. “The fact that ocean freight costs have skyrocketed will possibly lead to an increase in SOC market share.”

Barriers to use

The supply chain strategist noted that one drawback of using SOCs was a slightly higher operational process workload. However, Lehmacher said this could be easily addressed by stakeholders.

“Firstly, I think there needs to be more awareness about how the SOC option can help better manage the container freight value chain,” he said. “The business case needs to be clear.

“Secondly, in parallel to building awareness and knowledge, the industry needs to develop tools and automate as much as possible the leasing and purchasing of containers and the management of the entire flow – from loading to trucking and handling, to monitoring and delivering to the final destination. The more the process is digitized the lesser the burden.”