Container insurance is vital if you want to protect your fleet from damages or loss. Covering your units will help you avoid unexpected costs and protect your investments. Read this blog for your complete guide.

“Containerization” has been growing steadily in the last few decades. Millions of containers are being shipped via sea, land, and railway. But here’s the catch! Freight shipping also comes with some risks that result in container damage. Which is why it’s good to be prepared and invest in container insurance.

Container damage can add unnecessary financial strain on you as a shipper. However, not many owners and users opt for container insurance, due to lack of information. Let’s get into the basics of container insurance and see why it’s important to protect your investments.

What is container insurance?

Container insurance is a type of protection policy that offers reimbursement for the loss or damage of your container. These losses can occur from unpredictable weather circumstances, overturning, collision and damage to the ship.

The aftermath of container damage isn’t always kind to your wallet, so let’s dive into why this type of insurance is important and how it can benefit you.

Why do you need container insurance?

Many importers, shippers, and freight forwarders are unaware of the importance of container insurance. Most choose to skip out on it to save money, only for it to cost them buckets more if an unforeseen incident occurs.

By opting for container insurance, you can

- Protect your investments

- Get refunded for lost or damaged containers

- Lower your risk

- Safeguard your business and your wallet

Ensuring the safety of your goods in transit is the smartest way forward in freight shipping. Knowing which type of insurance is for you can also be beneficial, so let’s understand the 5 different types:

5 types of shipping container insurance

There are many brokers in the market offering insurance to container owners, lessors, and operators. Sometimes, insurance brokers offer containers together with cargo insurance.

Container insurance varies from broker to broker. However, in general, most insurances cover the following aspects:

- Physical loss and total loss

- Recovery and maintenance costs (Full Equipment Cover)

- Damage repair and lost units

- Third-party liability (for example: chassis)

- Coverage on residual value on equipment

Container insurance might not cover certain conditions:

- Mysterious disappearance

- Insolvency

- Mechanical/electrical breakdown

- Errors in design/manufacturing

- Depreciation, inconsistent maintenance routines

During the shipping process, containers are inspected when they are returned to the owner. If damage is found on a container, the owner makes a cost estimate for fixing the damages.

This estimate is then sent to the container user. The user arranges another inspection to recheck the charges. After that, the user and the owner negotiate the cost estimate. The charges are then settled using the insurance brokers. When the insurance is not a part of the deal, the user faces the inconvenience of paying from their own pocket.

When we talk about insurance in this industry, it’s difficult to get around the P&I clubs. Here’s the lowdown on Pi Club.

Why do you need to insure your containers against loss at sea?

In July this year, a CMA CGM shipping vessel lost 99 containers off the coast of South Africa while on route from Asia to Europe. Rough weather caused a stowage collapse, and containers fell overboard.

Every year, between 200 and 2000 containers get lost at sea due to extreme weather, improperly stacked containers and fires onboard. Shipping Containers Lost At Sea

Although rare, losing containers at sea can be expensive and inconvenient, so it’s important to plan ahead and include this coverage in your insurance plan. Luckily, with xChange, you can. Keep reading to find out more.

Who is responsible for container damage?

If you’ve been in the industry for some time, you’ll know that it’s important to be aware of the responsibilities following container insurance. Starting with who is responsible for container damage?

The freight carrier is accountable for delivering the shipment undamaged and in excellent shape and condition. The shipper must make sure that the products were undamaged when they were received and that they were still useful when the carrier picked them up.

The number and extent of the damage must be counted and documented. There are exceptions to the rule that the carrier is liable for damage claims resulting from events such as damage from severe weather conditions, war, terrorism, or where it can be demonstrated that the firm transporting the goods was careless in the packing or labeling of the products.

Container insurance can also be confused with cargo insurance. And most often, these two terms are used interchangeably. To avoid the confusion, let’s distinguish the two for you.

What is cargo insurance?

Cargo insurance safeguards Cosco Shipping Container from loss, damage, or theft while they’re in transit, so your goods are shipped off safe and sound. There are many ways that cargo insurance can be beneficial.

Container insurance vs. cargo insurance

Container insurance and cargo insurance are not rivals, in fact, getting the two together can be most rewarding. Some insurance brokers may offer both as a package deal, however, it can be separated if you’re thinking of opting for just one.

- Container insurance: Protects the freight forwarder or carrier

- Cargo insurance: Protects the shipper or manufacturer

What are the benefits of cargo insurance?

Cargo insurance reduces financial loss regardless of whether your goods get damaged or not. Some of the common benefits include:

- All risk coverage – Cargo insurance protects against the significant loss or damage caused by external factors such as theft, vermin or damage by improper handling.

- General coverage – This is the standard insurance policy for maritime shipments covering partial losses to the policyholder.

- Warehouse-to-warehouse coverage – As the term signifies, it protects against loss or damages caused while your cargo is being transported to and from warehouses.

- Peace-of-mind – Securing your investment gives you a sense of peace, which means you can sit back and relax knowing your cargo is safe.

Why do you need cargo insurance?

Picture this: You’ve just sent off an important shipment that’ll ultimately break your bank if it were damaged, BUT you haven’t insured it. The phone rings and you’re informed that there’s been an unfortunate accident. Sadly, your cargo is now, as they say, floating with the fish. Should you have taken Learn more? The answer is yes!

Your freight is exposed to a great deal of risk as it moves through numerous ports in transit. The longer you leave it unprotected, the bigger the risk becomes. There are outside factors to consider such as weather conditions, theft and container loss.

If you’re trying to avoid paying out of your pocket for the damage, insurance might be your best bet even though it isn’t always required. Better safe than sorry!

Now let’s take a quick look at what won’t be covered with cargo insurance.

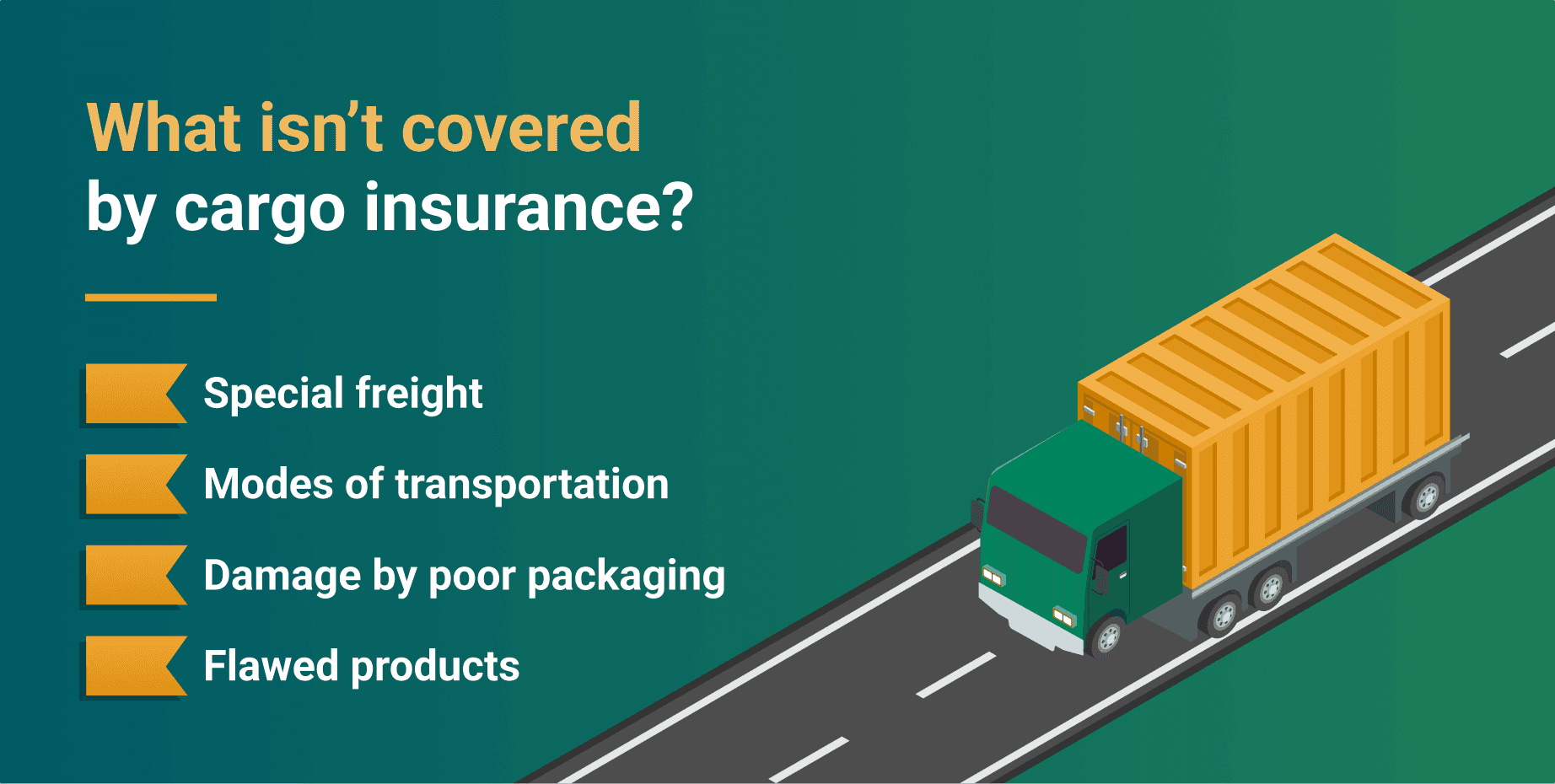

What’s not covered by cargo insurance?

Most insurance policies offer comprehensive damage cover, however, they may not cover all the specifics. These include:

- Special freight: Your insurance may not cover any hazardous cargo, specific electronic devices, and other expensive or delicate things.

- Modes of transportation: Some policies will only cover your freight depending on the type of transportation mode you use. (sea, land, air etc.)

- Damaged by poor packaging: Your insurance company might not cover any damage to your goods if they’re linked to poor freight packaging.

- Flawed products: You might not be covered for cargo damage that could be caused by faulty products in your package.

So before you choose an insurance type, remember to check with your insurance company first.

Now, besides container and cargo insurance, there’s another type of insurance we need to highlight: freight insurance. Read more about this type of coverage below.

What is freight insurance?

Freight insurance is a policy that gives partial or total protection against losses caused to the cargo during transit. As we have seen, problems can occur at any point of the shipping journey. Your cargo might get damaged due to errors in loading, unloading, and trucking, faulty packaging, and weather-related issues. Or, your shipment can even get stolen or lost.

And, unfortunately, these accidents are more common than you think. Container Damage

Usually, a standard insurance by carriers will only offer you a blanket amount as coverage. This amount may not recover the true value of your precious cargo. Imagine if your high-value shipment of electronic goods gets damaged and you’re not even able to recover half its value. Won’t that leave you frustrated?

To avoid this, shippers buy freight insurance from third-parties. Such independent insurance policies help you regain the true value of your freight. Also, you don’t have to go through the painful process of proving liability if the damage occurs. The claim will be handled directly by you and the insurance company.

How container insurance can save you money

Here’s a quick example of how using the right insurance can save you a lot of money.

48 containers were leased out to one of our customers, of which 38 units returned heavily damaged. The overall repair estimate proposed by the depot was US $34,648.3.

Thanks to Premium Insurance booked by the user, xChange was able to organize a neutral 3rd party survey, which determined that the depots were overcharging and suggesting unnecessary repairs. The actual damage was the limited to US $26.578.

Insurance covered US $11,000 of the impact damages, minimizing the amount the customer had to pay to just US $15,000. With Premium Insurance, the customer was able to save US $19,648!

How to inspect containers for damages

When inspecting a container for damages, there’s a number of important things you need to look out for. Here’s a quick checklist:

Outside/undercarriage: Check for an structural damage, dents or holes. Make sure the support beams are visible, and that no foreign objects are mounted on the container.

Doors (interior and exterior): Ensure all locks are in good working order and effective, hinges are secure and that no bolts are loose.

Right & left container sides: Check for any unusual repairs to structural beams and any signs of false walls or hidden compartments.

Front wall: Interior blocks in top left and right corners should be visible, as well as vents. Check for signs of a false wall or hidden compartment.

Ceiling & roof: Make sure support beams and ventilation holes are visible. Check that no foreign objects are mounted on the container. Check for signs of a false ceiling or hidden compartments.

Floor: The floor must be flat, clean and dry. Check for unusual repairs, false floors or hidden compartments.

Now that you know how to run through the container inspection checklist, let’s look at how to get insurance with xChange.

Get insured against damage, mysterious disappearance & loss at sea with xChange

Container xChange with the help of Learn more offers container insurance to customers. Container suppliers can include insurance as part of container usage on every transaction they make or on a case-by-case basis. Regardless, the user of the container always pays for the insurance.

Whether you have containers under management on our platform or not, Container xChange customers can benefit from the following coverage:

Containers lost at sea: If containers fall overboard due to extreme weather at sea, you’ll be covered.

Impact damages and careless handling: Dents, holes and other damage caused by improper container handling will be paid out.

Mysterious disappearance: If your containers vanish unexpectedly, and you can’t get hold of your partner, you’ll avoid huge losses with our coverage.

Damages beyond repair and units bent out of shape: In the unfortunately even that your containers get damaged beyond repair, or seriously misshapen, you’ll receive the compensation you deserve.

Our container insurance provides thorough coverage for (actual) total loss, constructive total loss, general average, and strange disappearance. Our goal is to lower risk and liability while performing one-ways on Container xChange. You can add container insurance to any deal.

Basic and Premium insurance with xChange

Basic Insurance covers containers lost at sea, mysterious disappearance, or extensive damage. The insurance is valid for one-way moves up to 60 days from the day of pick-up. The insurance renews automatically after the 60 days unless you report that the unit has been returned empty.

Premium Insurance covers all kinds of physical damage a container can go through. That includes a total loss. Physical damage can happen because the vessel sways, the crane lifters mishandle the container, heat damages the container, a train that derails, and so on.

Our premium insurance covers any costs that go above the DPP (Damage Protection Plan). The DPP helps to compensate for the regular maintenance and repair after the container is used. The container supplier pays for the DPP.

DPP is useful when you don’t want to make damage assessments every time you lease out a container. It takes care of all the repair costs if it falls under the negotiated DPP amount.

Premium insurance is valid for one-way moves up to 60 days from the day of pick-up. The insurance renews on a day-to-day basis unless you report that the containers have been returned empty.

Ready to cover your investments and protect both your business and your wallet from unexpected incidents? There’s no better time to insure your units than right now. Click below to chat to our expert team about protecting your containers today.

What is container insurance?

Container insurance is a protection policy that reimburses loss from container damage

What does an ocean cargo policy cover?

An ocean cargo policy covers goods while in transit, including during custom delay or in situations that cannot be controlled.

What is the cost of container insurance?

The cost of container insurance varies from broker to broker. The price is dependent on the type of insurance you take, as well as the broker you choose.