23.07.2024

Mixed signals from China’s shipping container trading and leasing markets

- Average container prices in China stabilize for the first time in 2024

- Leasing rates from China to the US and Europe continue to surge in July

Shanghai, China – July 23, 2024 –

Container xChange released its latest monthly China market update, revealing that the average container prices in China have held steady in July for the first time in 2024.

Chart 1: Average prices for 40 ft high cube cargo worthy containers, July 2023 to July 2024

Chart 1: Average prices for 40 ft high cube cargo worthy containers, July 2023 to July 2024

While the average container prices (for container trading) in China stabilize this month, the average leasing rates from China to the US and China to Europe continue to surge in July.

Table 1: Month on month comparison of average leasing rates for 40 ft HC containers

Table 1: Month on month comparison of average leasing rates for 40 ft HC containers

“The recent volume increase and subsequent container price hikes, was primarily driven by the pulling forward of orders, raising questions about the strength of underlying demand. If this demand proves to be weak in the H2 of 2024, we could see container prices and freight rates momentum decline.” shared Christian Roeloffs, cofounder and CEO of Container xChange, the global online marketplace for container trading and leasing.

In the short term, Container xChange reports that average leasing rates for westbound trade from China have continued to surge throughout July.

Muhammad Farhan Khan, CEO at Sourcing Riders Ltd (Import & Export Company in China), shared that, China’s container demand is surging, particularly for shipments to the US, driven by increased consumer spending. However, capacity constraints and disruptions in major shipping routes have led to significant spikes in leasing rates. Despite these challenges, container prices have not significantly increased in July 2024, indicating a more balanced market. The overall situation remains dynamic and volatile.”

According to Farhan, the updated Ocean freight rates for August’s 1st half on the China to US West Coast have reached $8,800 (August 1-15, 2024) from $8,200 (for July1-15 2024) and for China to US East Coast have also increased to $9,700 (August 1-15, 2024) from $9,100 (for July1-15 2024)

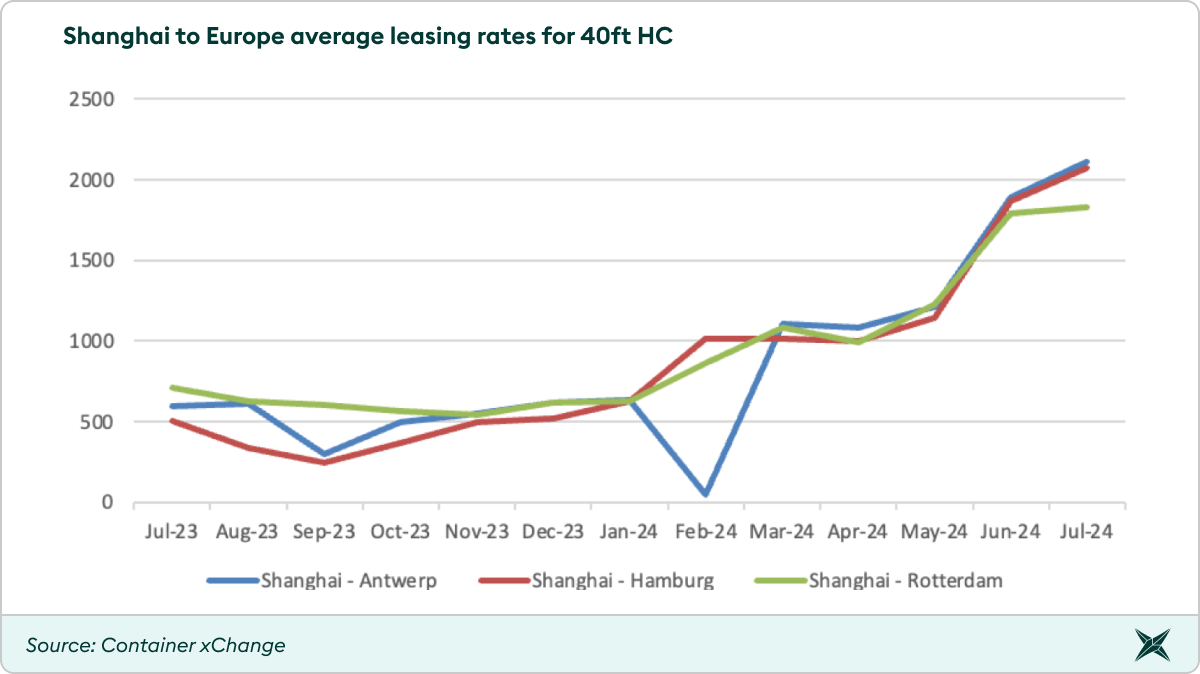

China to Europe average container leasing rates rise at a slower pace

Average container leasing rates on the China to Europe route continue to rise but at a slower pace this month. Month-to-month increases from June to July 2024 show a continuing trend of rising costs. Looking at the longer duration, the year-over-year increases highlight the impact of the Red Sea crisis, which caused container prices to inflate throughout this year.

Chart 2: Shanghai to Europe average leasing rates for 40ft HC, July 2023 to July 2024

Chart 2: Shanghai to Europe average leasing rates for 40ft HC, July 2023 to July 2024

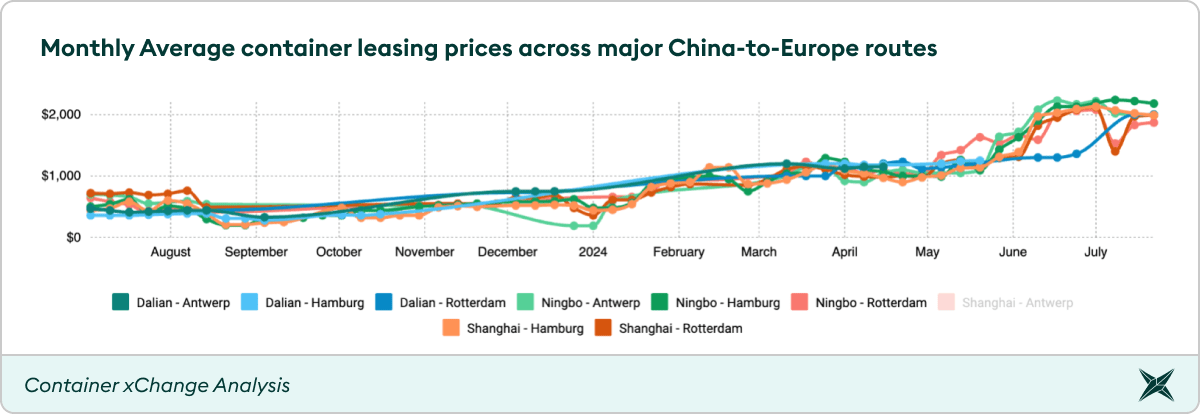

Chart 3: Monthly Average container leasing prices across major China-to-Europe routes, July 2023 to July 2024

Chart 3: Monthly Average container leasing prices across major China-to-Europe routes, July 2023 to July 2024

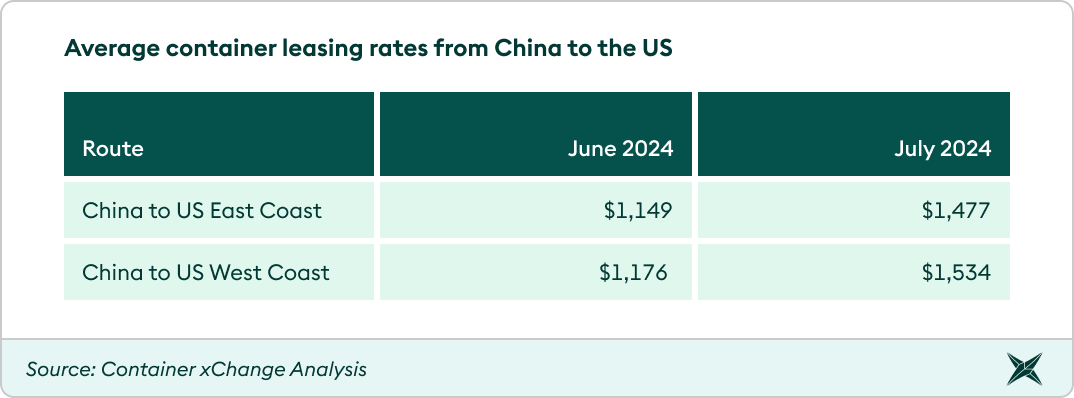

Higher average leasing rates from China to US West Coast compared to East Coast

Container leasing rates continue to climb on the China to US route, with significant month-to-month increases from June to July 2024, reflecting ongoing congestion and supply chain disruptions impacting this route.

According to the data, average container leasing rates are generally higher on China to US West Coast (Long Beach, Los Angeles) routes compared to the US east coast.

From the data, the average container leasing rates from China to the US West Coast in July 2024 are higher compared to those to the US East Coast.

Table 2: Average container leasing rates from China to US east and west coast in June and July 2024

Table 2: Average container leasing rates from China to US east and west coast in June and July 2024

Labor negotiations at U.S. East Coast and Gulf of Mexico ports pose a significant risk for shippers already dealing with extended transit times and increased costs. The International Longshoremen’s Association (ILA) contract, covering 45,000 dockworkers from Maine to Texas, expires on September 30.

Canadian routes also witness a substantial increase but tend to be slightly lower than the US counterparts.

Market Outlook

While the current data indicates a potential stabilization in container prices, the market remains sensitive to global economic conditions and trade dynamics.

“The macroeconomic indicators from China reveal a mixed picture. House prices have dropped more sharply than anticipated, declining by 4.5% year-on-year compared to the forecasted 4.1%. GDP growth also fell short of expectations at 4.7% versus the predicted 5.0%, and retail sales increased by only 2% year-on-year against a forecast of 3.2%. On the other hand, June exports showed a positive trend, rising by 3.6% year-on-year for the first six months of 2024.

Carriers and leasing companies are optimistic about a further upswing in trade activity. However, we believe that the current surge in demand is primarily driven by large retailers preemptively managing inventories for the peak season, rather than a robust demand recovery. Consequently, the likelihood of container prices sliding and stabilizing at a lower level is high. The recent stabilization of container prices in China aligns with our earlier forecast, suggesting that the peak of price hikes may have been reached or is nearing soon.” Shared Christian Roeloffs, cofounder and CEO of Container xChange.

For similar analysis visit https://www.container-xchange.com/market-intelligence-hub/